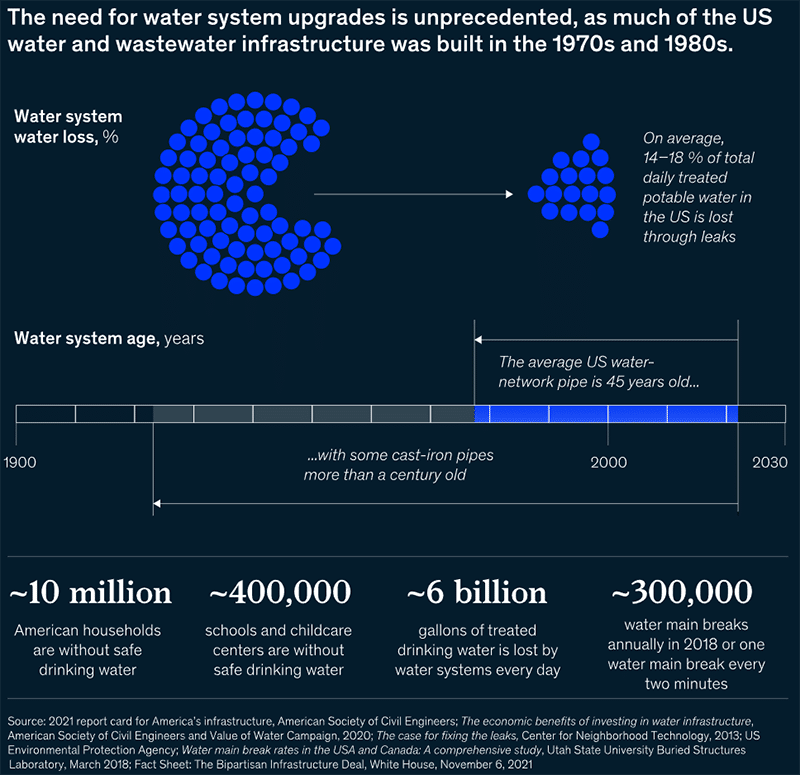

As investments in infrastructure and resilience see a resurgence in North America and Europe, public water is seeing renewed political attention.

After decades of limited investment, the backlog of modernization projects has grown, and major financing packages have been discussed and approved recently.

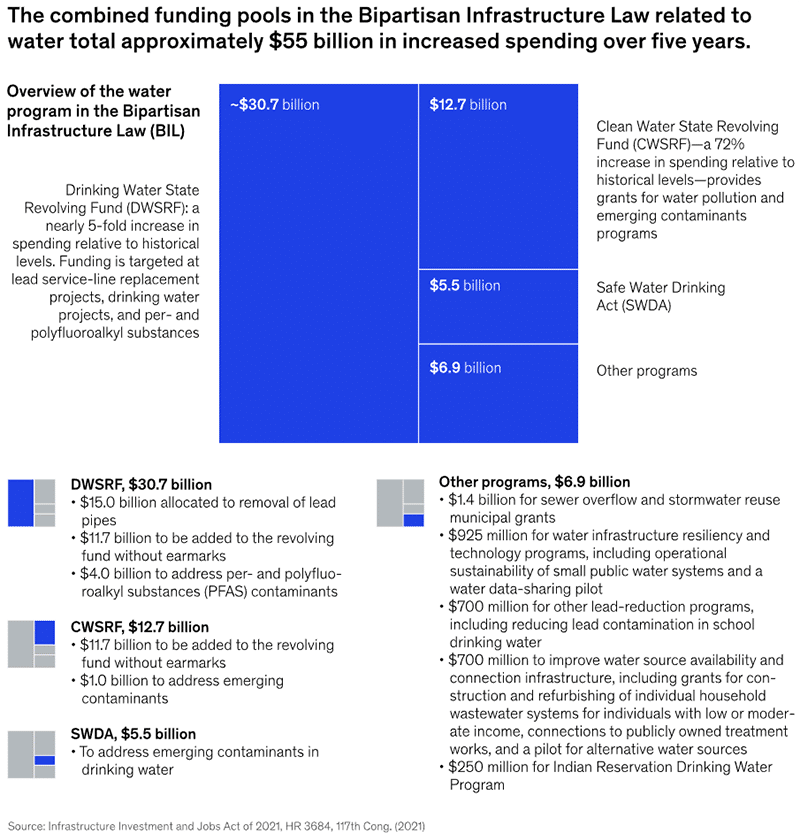

As an example, the U.S. Bipartisan Infrastructure Law will authorize $550Bn in new spending, that includes $55Bn on water initiatives over the next 5 years.

Out of the different funded programs, the Drinking Water State Revolving Fund will be allocated $30Bn over the next 5 years, which is more than the previous 25 years combined ($25 billion). The Clean Water State Revolving Fund will see a doubling of the funds allocated.

In Europe, a recent OECD report points projected investment needs across member states for water supply and sanitation from 2020 to 2030. The aggregate figure for the 28 member states amounts to €289Bn, with sanitation representing the lion’s share of the total additional expenditures.

Comparing the additional expenditures for water supply and sanitation with the current baseline shows the additional level of effort. On an annual basis, all countries will need to increase annual expenditures by an average of about 40%.

Eliminating lead pipes, minimizing leakage, energy consumption, phosphorus and nitrogen wastewater discharge are some of the highest profile challenges that need to be addressed quickly. All this while maintaining uninterrupted utilities services at an affordable cost, with a workforce that is increasingly difficult to attract and retain.

Indeed, work on water facilities and networks is often drudging and dangerous, while work processes themselves have undergone limited evolution. Poor technical data records of the actual status of facilities often leads to additional work exposure. All of this results in limiting the appeal of these roles to the younger generation.

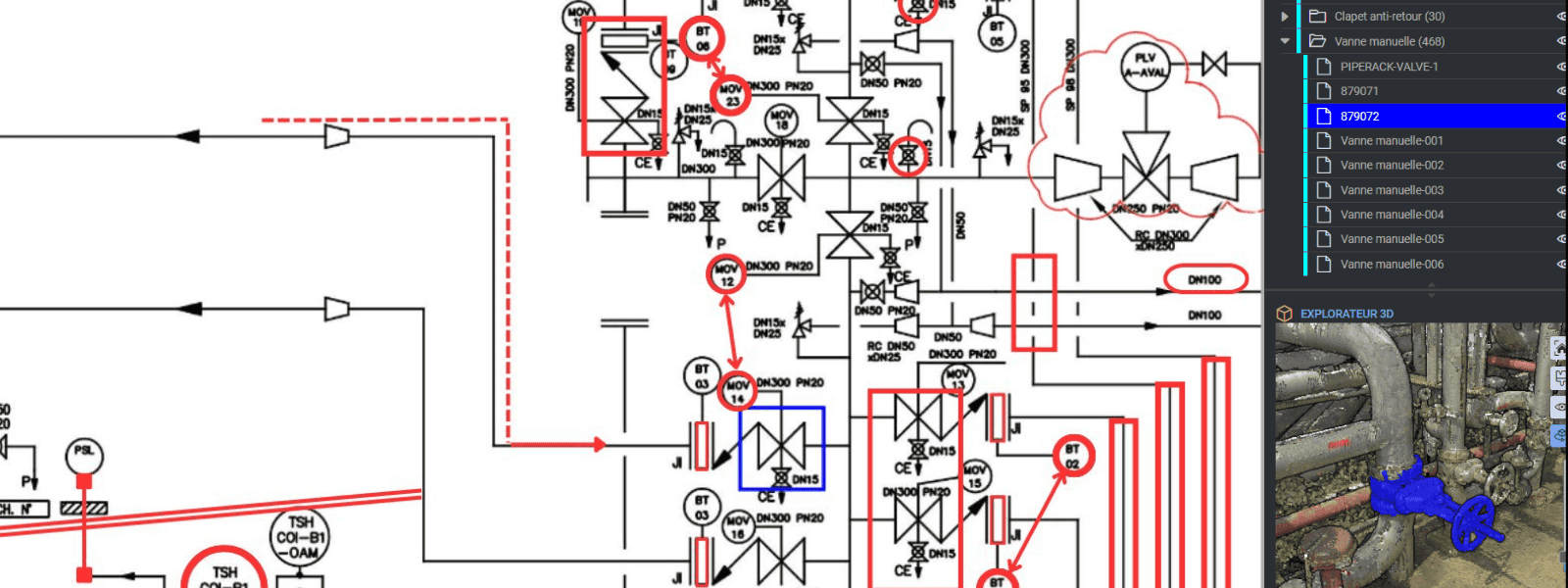

Many companies have launched programs to reverse this trend and to catch up on the modernization backlog. Yet, most of the time, the foundation layer is missing: no one has a common understanding of the as-built assets status. With outdated assumptions, sophisticated approaches can only lead to subpar results.

“garbage in, garbage out”

Moreover, generating data without the ability to easily consume it or ensure that it stays current means that digital initiatives often stall. End users lose patience with ever-longer implementation times, complex training, poor usability….

That’s why we focus on ONE fundamental industry need at Samp: setting up an “always fresh” view of as-built facilities in days, with little input data. In doing so, we re-enable sound investment decisions based on an up-to-date understanding of industrial assets throughout the chain of command.

Such transparency restores trust among stakeholders, while enabling faster and more robust project estimation, safer execution, efficient handover, and improved maintainability.

Because investment in public water infrastructure is vital, it is important to ensure that the money spent on it has the highest possible impact.

Want to discuss these topics in more detail and take action?

Let’s meet in person at BIM World in Paris where Samp will be present on the SUEZ booth (F91) on April 5th & 6th. As always, you can make a virtual appointment with us at any time!

Sources:

McKinsey (2022), The US Bipartisan Infrastructure Law: Reinvesting in water

McKinsey (2021), US water infrastructure: Making funding count

OCDE (2020), Financing Water Supply, Sanitation and Flood Protection : Challenges in EU Member States and Policy Options, OECD Studies on Water